Solar surging 58% in 2023, 413 GW of installations expected globally

About three weeks ago, I was sitting at dinner with Mr. Chen Lin, who is considered one of the top experts in the role of Silver in Solar Panels. We discussed methodologies for the World Silver Survey published by the Silver Institute and agreed on some of their methodology problems. (At least they’re trying)

Most believe they do OK work. I give them a letter grade of C minus. They need to be using updated silver use categories instead of the misinformation handed to them by the USGS.

The USGS sent them an outdated template to obfuscate silver use in an intentional attempt to make silver demand look smaller than it is. This is a way to keep future silver investors unenthusiastic.

So, instead of being cheerleaders for Silver, they may be out there gaslighting people and then coming up with a name like Silver Institute to confuse everyone. I am already proven right if you click through the last ten articles on this website.

Moreover, they need a lot of research help because tackling the job of a World Silver Survey use is a monstrous job. It is a superb project they are not qualified to pull off but a clever marketing ploy to keep their name in the news.

Their numbers could be better; they view it all from a “Western Lens,” including half the story. In some cases, though, being half right is good enough.

Plus, last we checked, I didn’t get a sense that they have any idea how much Silver is used in China, Russia, India, Iran, or any of BRICS (and though I have not seen their organizational chart), I don’t think they have a strong cast of researchers.

A job of this magnitude means they should only try to tackle this project with more assistance. I will rephrase. They may not be incompetent; they are understaffed and need a new set of eyes on their project.

Once we solidify more sponsors for this, we may publish “The Global Silver Report” while they have the World Silver Survey. Then, somewhere in the middle may be the best information.

OK, we’re walking our statements back; we don’t blame the Silver Institute; we blame the USGS.

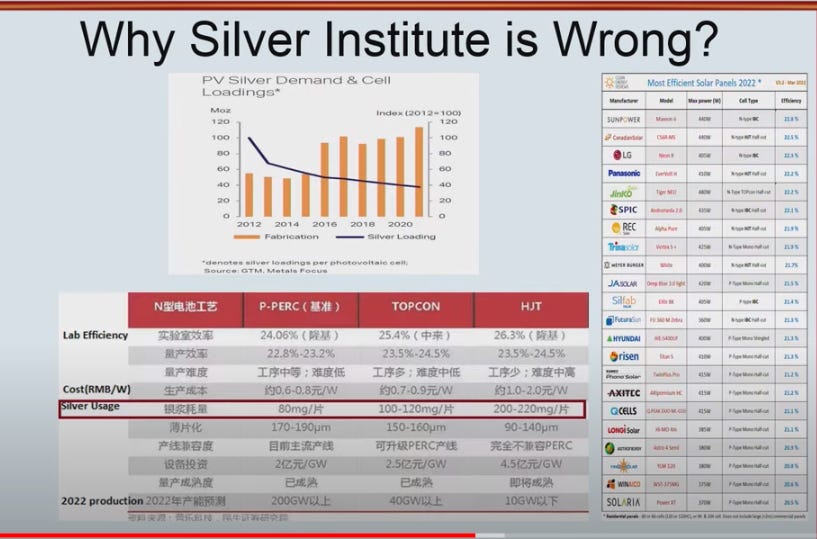

screenshot from Chen Lin’s Metals Investor Forum presentation “Silver, The New Lithium”

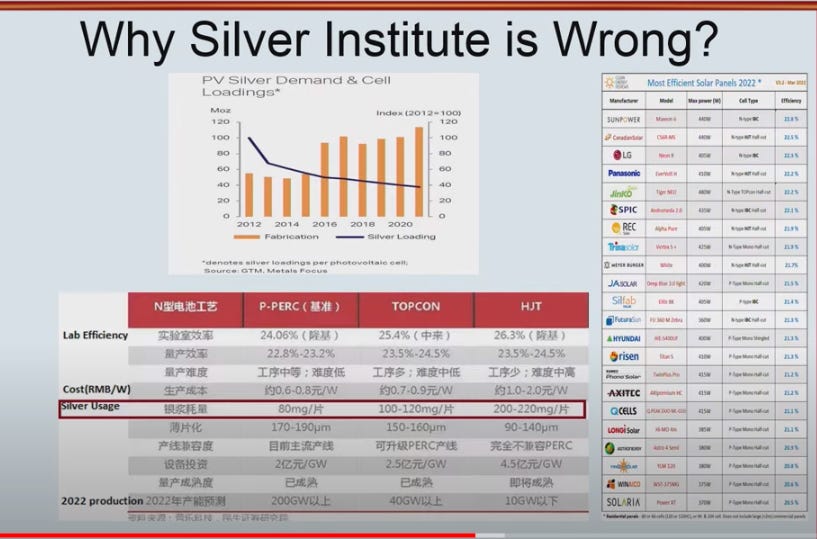

OK, back to Mr. Chen Lin, he states that each Megawatt = 500,000 ounces of silver.

So doing the math it looks like 413 GW Solar = 206,500,000 ounces of silver

BloombergNEF’s latest solar market outlook for 2023 paints an optimistic picture, projecting a substantial surge in solar module capacity installation globally. In this article, we delve into the key insights from the report, highlighting the dominant role of China, impressive growth figures, and the financial complexities faced by the solar industry.

According to BloombergNEF, the anticipated global installation of 413 GW of solar module capacity in 2023 signifies a remarkable 58% growth from the 260 GW installed in the previous year. Notably, this growth trajectory has been consistent, with 2022 witnessing a 42% increase from 2021. Over a two-year period, the world experienced a staggering 125% growth, indicating a doubling of annual capacity deployment in just one and a half years.

China emerges as a pivotal player in driving this capacity growth, contributing a substantial 240 GW. The country not only leads in installation but also significantly scales manufacturing capacity, resulting in a decrease in solar module prices to approximately $0.10/W.

In a recent episode of Bloomberg’s podcast “Switched On,” solar analyst Jenny Chase highlighted the industry’s dichotomy. While global solar capacity installations are experiencing a surge, the financial landscape for solar panel manufacturing remains challenging. Despite significant expansion in manufacturing capacity, manufacturers face intense pressure on profit margins, operating module assembly lines at only 60% capacity.

Clean Energy Associates predicts that China alone will host 1 TW of new annual solar panel manufacturing capacity, with over 800 GW already in place, particularly focusing on TOPCon solar cells by the end of 2024. This ambitious milestone follows the global deployment of solar modules surpassing 1 TW in the winter of 2022.

The article also emphasizes the unprecedented pace at which the solar industry is advancing. If the current deployment momentum is maintained, the world is poised to achieve its second terawatt of solar installations by 2024, accomplishing this feat in less than three years—a stark contrast to the approximately 40 years it took to reach the first terawatt.

Jenny Chase, in the podcast, expressed surprise at the current low module pricing, noting that a standard solar module costs 12.8¢/watt in a free trade market—below expectations and experience curve projections. This unexpected pricing trend has facilitated increased capacity installations globally, with China, in particular, seeing the development of wind and solar “megabases” with capacities of up to 20 gigawatts.

While the United States experienced a slowdown in total volume deployed in 2022 due to high hardware costs, global low module pricing has played a crucial role in driving China’s wind and solar megaprojects. Jenny Chase acknowledged that high trade barriers and interconnection capacity issues have slowed installation volumes in the U.S., but the Inflation Reduction Act is expected to alleviate these challenges and have a broad market impact.

Conclusion:

BloombergNEF’s solar market outlook for 2023 reflects a dynamic industry landscape, characterized by remarkable capacity growth, China’s dominant role, and financial complexities for manufacturers. The global solar sector is advancing at an unprecedented pace, with the potential to achieve its second terawatt of installations by 2024, signaling a transformative period for renewable energy.