January 18, 2024

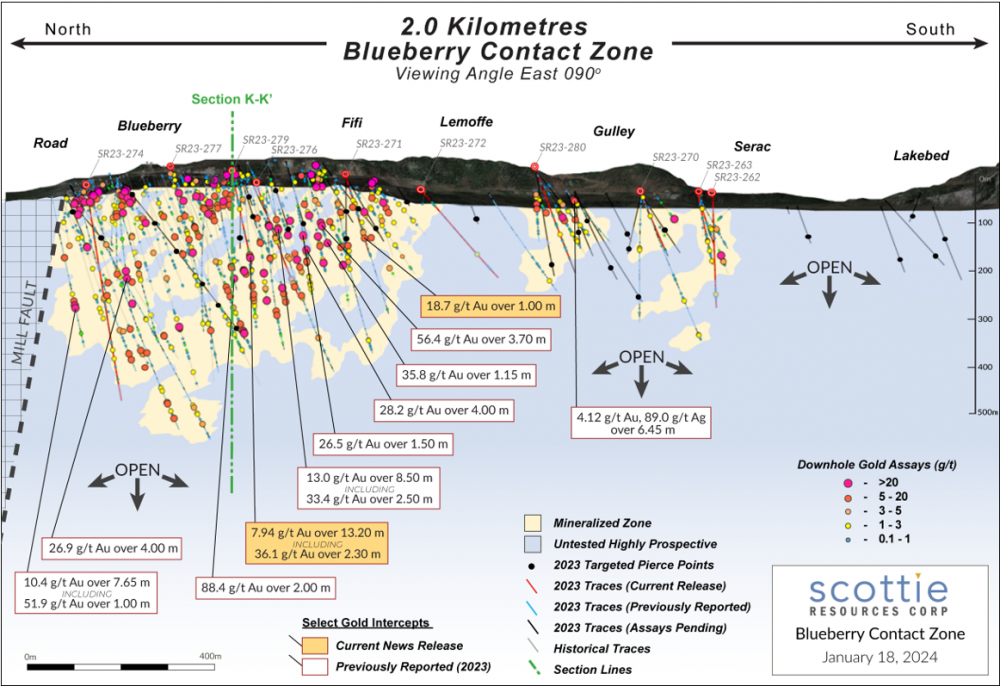

Vancouver, BC – January 18, 2024 – Scottie Resources Corp. (“Scottie” or the “Company”) (TSXV: SCOT) is pleased to report new assays on the Blueberry Contact Zone in British Columbia’s Golden Triangle, including several high-grade intercepts through the Fifi and Lemoffe vein zones along the Blueberry Contact. The Blueberry Contact Zone is located 2 kilometres north-northeast of the 100% owned and royalty free, past-producing high-grade Scottie Gold Mine, 35 kilometres north of the town of Stewart, BC, along the Granduc Road.

Highlights:

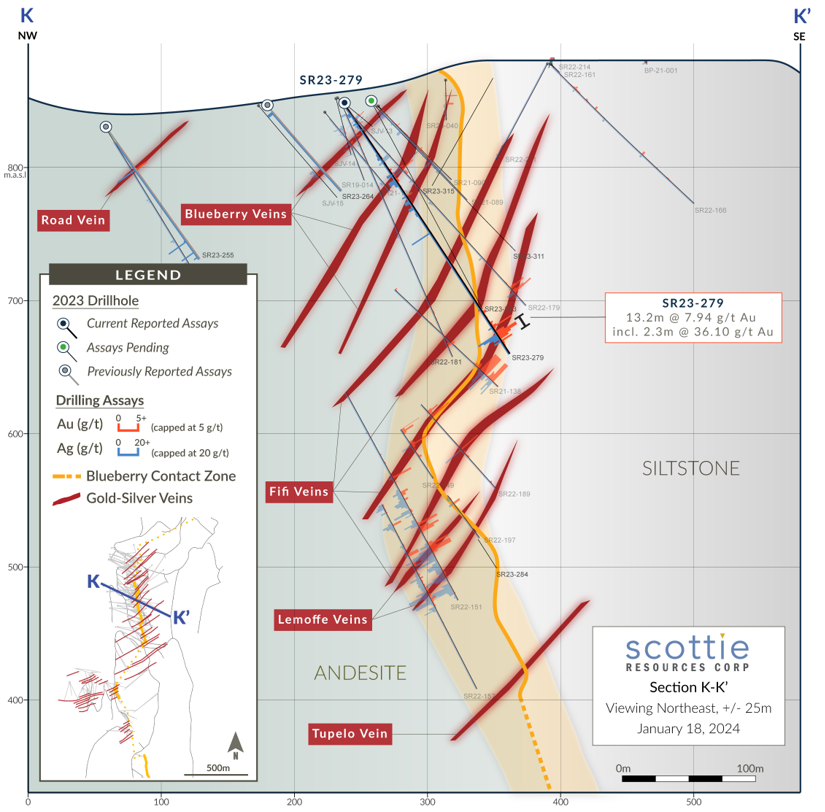

- Drillhole SR23-279 targeted the Blueberry – Fifi – Lemoffe vein zones, intersecting 7.94 grams per tonne (g/t) gold over 13.2 metres (m)including36.1 g/t gold over 2.30 m (Table 1, Figures 1,2,3)

- Intercepts start at a depth from surface of approximately 200 m

- The lower intercept occurs on the siltstone side of the Blueberry Contact Zone

- Drillhole SR23-276 targeted the Fifi – Lemoffe vein zones, intersecting 3.02 g/t gold over 5.25 m including 9.9 g/t gold over 1.25 m (Table 1, Figures 1,3)

- Drillhole SR23-271 intersected 18.7 g/t gold over 1.00 m on the Lemoffe vein zone (Table 1, Figures 1,3)

President and CEO, Brad Rourke commented: “Results from the Blueberry Contact Zone continue to define a robust system of high-grade sulphide-rich veins hosted in an envelope of lower-grade material centred around the near vertical andesite and siltstone contact. We welcome these results and look forward to releasing the remaining holes over the coming weeks and outlining priorities and targets for our upcoming drill season.”

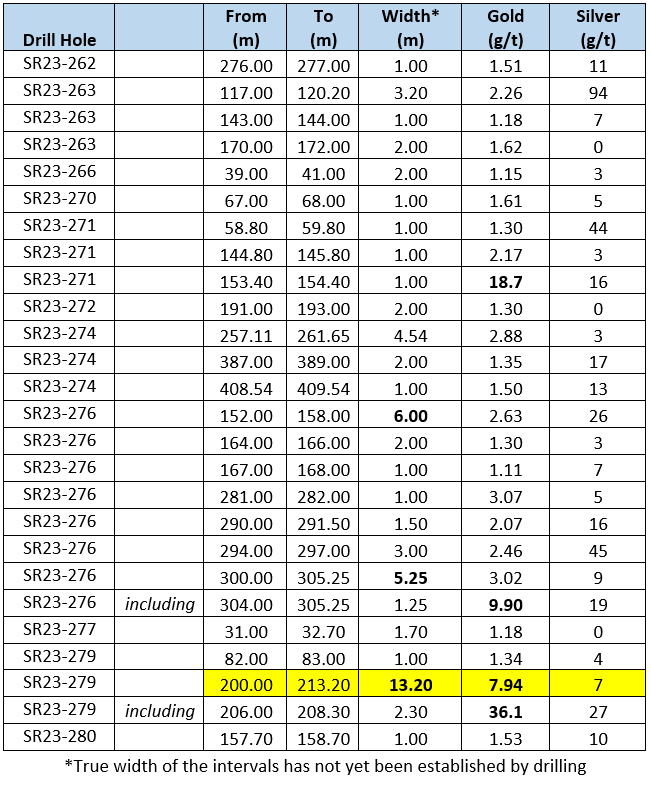

Table 1: Selected results from new drill assays (uncut) from the Blueberry Contact Zone.

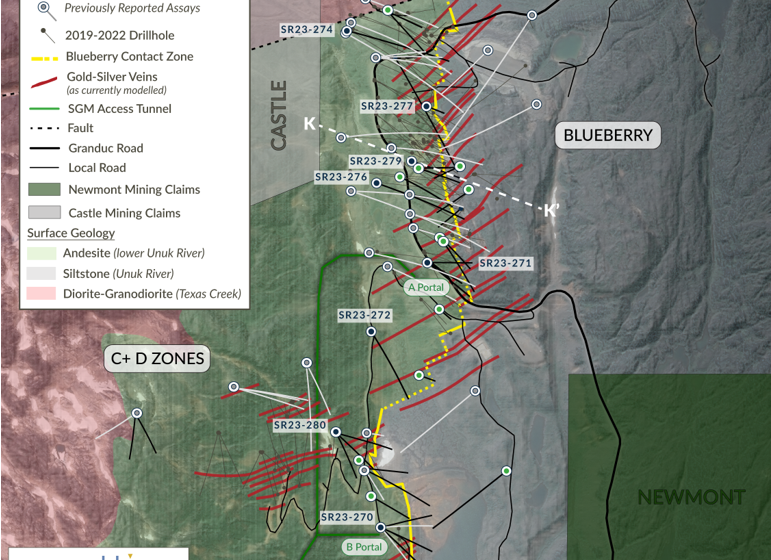

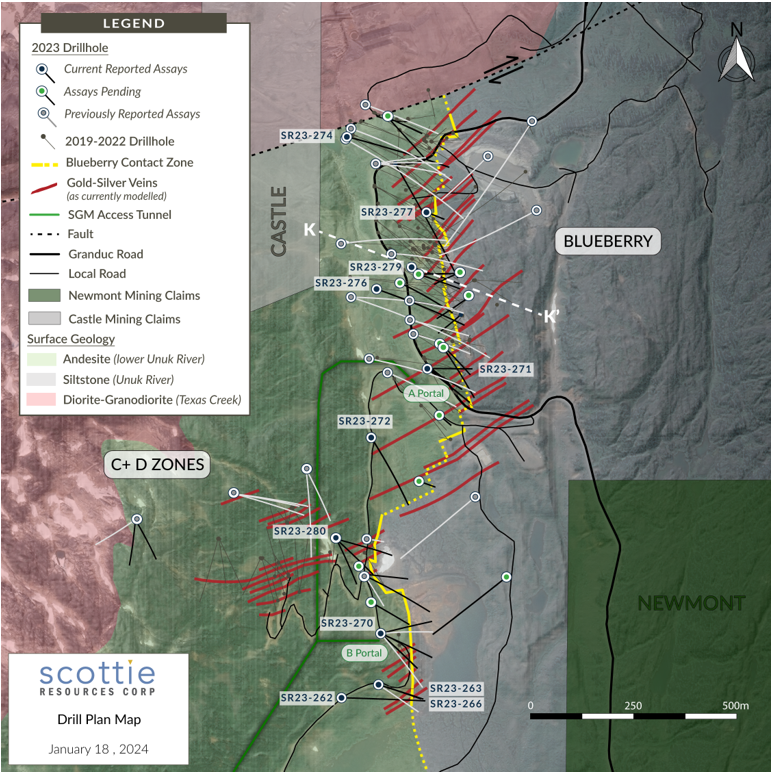

Figure 1: Overview plan view map of the Blueberry Contact Zone, illustrating the locations of the reported drill results, cross-section (Figure 2), and the distribution of the modelled sulphide-rich cross-structures.

Figure 2: Cross-section highlighting the recent intercept in SR23-279 relative to previously release intercepts of the vein structures.

About the Blueberry Contact Zone

The Blueberry Contact Zone is located just 2 kilometres northeast of the 100% owned, past-producing Scottie Gold Mine located in British Columbia, Canada’s Golden Triangle region. Historic trenching and channel sampling of the Blueberry Vein include results of 103.94 g/t gold over 1.43 metres, and 203.75 g/t gold over 1.90 metres. Despite high-grade surficial samples and easy road access, the Blueberry Vein had only limited reported drilling prior to the Company’s exploration work. The target was significantly advanced during Scottie’s 2019 drill program when an interval grading 7.44 g/t gold over 34.78 metres was intersected in a new N-S oriented zone adjacent to the main Blueberry Vein. The drill results received from 2020 – 2023, coupled with surficial mapping and sampling suggest that the N-S mineralized trend is a first order structure that hosts an array of SW-trending, sub-parallel, sulphide-rich veins that obliquely crosscut it which host high-grade gold. As of the end of 2022, the extent of the N-S zone, defined by the contact between andesite and siltstone units of the Hazelton Formation and the presence of the cross-cutting sulfide-rich structures, has a drilled strike length of 1,550 metres and has been tested to 400 metres depth. The Blueberry Contact Zone is located on the Granduc Road, 20 kilometres north of the Ascot Resources’ Premier Project, which is fully financed for construction. Newmont’s Brucejack Mine is located 25 kilometres to the north.

Figure 3: Segmented vertical long section of the Blueberry Contact Zone illustrating the distribution and status of drilled targets from the 2023 season and the reported results thus far, relative to intercepts from previous drilling campaigns.

Financing

The Company also announces a non-brokered private placement of securities for aggregate gross proceeds of up to $5,000,000 (the “Offering”).

The Offering will be comprised of a combination of: (i) non-flow-through units (the “NFT Units”) to be sold at a price of $0.18 per NFT Unit for aggregate gross proceeds of up to $2,000,000 (the “NFT Offering”); and (ii) flow-through units (the “Charity FT Units”) to be sold at a price of $0.27 per Charity FT Unit for aggregate gross proceeds of up to $3,000,000 (the “Charity FT Offering”). Each NFT Unit will be comprised of one common share in the capital of the Company (a “Common Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Charity FT Unit will be comprised of one Common Share that will qualify as a “flow-through share” within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “Tax Act”) and one-half of one Warrant. The Warrants for all units will be subject to the same terms, with each Warrant entitling the holder thereof to purchase one Common Share (a “Warrant Share”) for a period of three (3) years from the date of issuance at an exercise price of $0.28 per Warrant Share.

The Company intends to use the gross proceeds raised from the Charity FT Offering for exploration and related programs on the Company’s Scottie Gold Mine Project property which includes the Blueberry Contact Zone, and the gross proceeds from the NFT Offering for general working capital and administrative purposes.

The entire gross proceeds from the Charity FT Offering will be used for Canadian Exploration Expenses as such term is defined in paragraph (f) of the definition of “Canadian exploration expense” in subsection 66.1(6) of the Tax Act, and “flow through mining expenditures” as defined in subsection 127(9) of the Tax Act that will qualify as “flow-through mining expenditures”, and “BC flow-through mining expenditures” as defined in subsection 4.721(1) of the Income Tax Act (British Columbia), which will be incurred on or before December 31, 2025 and renounced with an effective date no later than December 31, 2024 to the initial purchasers of Charity FT Units.

The Company may pay finders’ fees comprised of cash and non-transferable warrants in connection with the Offering, subject to compliance with the policies of the TSX Venture Exchange. All securities issued and sold under the Offering will be subject to a hold period expiring four months and one day from their date of issuance. Completion of the Offering and the payment of any finders’ fees remain subject to the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

Termination of the Independence and Silver Crown Option Agreement

Scottie reports that the corporation has terminated the Independence and Silver Crown Property Option Agreement that was entered into by AUX Resources Ltd. on June 5, 2020, and will have no further interest in the property. 100% of all rights, title and interest will revert back to Richard Billingsley. Scottie acquired the option agreement when it merged with AUX Resources Ltd. in 2021.

Quality Assurance and Control

Results from samples taken during the 2023 field season were analyzed at SGS Minerals in Burnaby, BC. The sampling program was undertaken under the direction of Dr. Thomas Mumford. A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic absorption spectrometry and gravimetric finish when required (+9 g/t gold). Analysis by four acid digestion with multi-element ICP-AES analysis was conducted on all samples with silver and base metal over-limits being re-analyzed by emission spectrometry.

Dr. Thomas Mumford, P.Geo., a qualified person under National Instrument 43-101, has reviewed the technical information contained in this news release on behalf of the Company.

ABOUT SCOTTIE RESOURCES CORP.

Scottie owns a 100% interest in the Scottie Gold Mine Property which includes the Blueberry Contact Zone and the high-grade, past-producing Scottie Gold Mine. Scottie also owns 100% interest in the Georgia Project which contains the high-grade past-producing Georgia River Mine, as well as the Cambria Project properties and the Sulu and Tide North properties. Altogether Scottie Resources holds approximately 58,500 hectares of mineral claims in the Stewart Mining Camp in the Golden Triangle.

The Company’s focus is on expanding the known mineralization around the past-producing mines while advancing near mine high-grade gold targets, with the purpose of delivering a potential resource.

All of the Company’s properties are located in the area known as the Golden Triangle of British Columbia which is among the world’s most prolific mineralized districts.

Additional Information

Brad Rourke

President and CEO

+1 250 877 9902

[email protected]

Gordon Robb

Business Development / IR

+1 250 217 2321

[email protected]

For the Full Press Release check this out