Can You Trust the Silver Market? Stackers Say “Hell No” After Silver Institute’s History of Deception is under Investigation.

Sources from this article are from Pixy, The Free Speech Open Source Portal protected by section 230 of the CDA. Pixy can be found throughout our Reddit communities.

For more information, please join Pixy and the Silver Stacking movement.

One Dozen takeaways from this article.

- The Silver Institute does not want Silver to be a valuable commodity.

- The Silver Institute, in fact, does the opposite.

- The Silver Institute would rather the US dollar be the #1 asset

- The existence of the Silver Institute is to obfuscate Silver uses and mislead investors, which is the opposite of what they should be doing (promoting Silver so investors can be adequately and fairly rewarded.)

- Their entire existence and most of their publications have been deceptive publications meant to keep a secret.

- This is part 1 of 20 articles leading into their inglorious World Silver Survey.

- The result is that by the Fall of 2024, their legitimacy, reputation, and credibility will go to zero, and soon, their sponsors will run for the Fire Exits.

- No mining company will want to be subject to the “market heat” (being in the hot seat) or shareholder backlash by being associated with Scammy Silver Institute.

- We want to emphasize that there are zero faults with the mining companies that were “roped into their Silver scam.”

- Our official position is that they had yet to learn what was happening behind the scenes. We will get to this in upcoming articles.

- 2 sheep metaphors follow; “They were fleeced.” and “The wool was pulled over their eyes.”

- All the fault lies with two people we have researched thus far, but as the scandal unfolds and the coverups surface, there may be more than just two gentlemen behind the sinister Silver Institute.

Context: Buying into our thesis only works if you understand that the Opposite of Silver is The US Dollar

This article will only make sense if the reader understands the historical struggle of Silver and Gold in price discovery. This profound pattern is indisputable, and no one to date can find an exception to this law of human nature that is just as much a law as any scientific law such as gravity (follow the works of Mike Maloney, James Turk, Alasdair Macleod, Peter Schiff, or our research team)

Historically, bankers and kings (or bankers and emperors or bankers and prime ministers or bankers and presidents) have executed scams like this.

- The Silver and gold are vaulted (taken out of circulation)

- The “Ruling Class” then uses the power of legislative bodies, central bankers, and tax collectors to shove fiat instruments down the throats of the villagers.

- Fiat instruments are either war bonds or fiat currency made of paper with no intrinsic value.

- These fiat notes (we have the Federal Reserve note) are gold and silver substitutes.

- The King, Emperor, Prime Minister, and Presidents serve to please the Central Bankers.

- The Central Bankers get their authority from the laws, and the whole thing is backed by guns, police forces, the military, and mainstream media.

- This cabal (syndicate of Central bankers and governments) forces villagers to pay taxes on these fiat notes. For historical context, when Columbus conquered our indigenous ancestors, he would demand taxes, stating, “It was expensive conquering you savages.” When the indigenous folk wouldn’t surrender the decreed amount, Columbus and his army would chop off the villager’s hands, and they would bleed out. This would send a strong message to “be a good little Indian” and pay your taxes to the King and his men.

- The central banking warfare model then finds every reason to wage unending wars funded by printed fiat.

- In so doing, the villager’s time, talent, energy, and labor are exchanged for fiat notes that are incrementally devalued over time; a reset occurs, and each and every time, Gold and Silver step up to do all the accounting for the crime, corruption, murder, war, and theft inflicted on humanity. The perpetrators are the fiat overlords.

- The central bankers and their client governments and militaries are responsible for misery, poverty, and death.

- Their clients stand closest to the money printers, and the villagers subsidize the scam.

- This is what describes the systematized oppression from the Central Bankers victimizing the 99%

- Anytime someone voices opposition, the orchestrators of oppression follow this script (First, they ignore you, then they laugh at you, then they fight you, then you win)

- We are somewhere between the fight and the win.

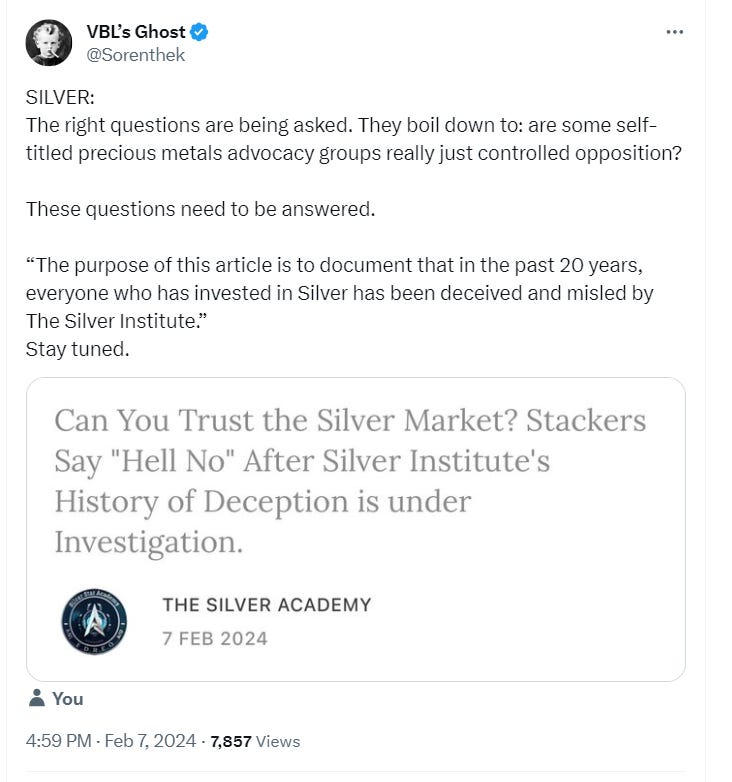

The purpose of this article is to document that in the past 20 years, everyone who has invested in Silver has been deceived and misled by The Silver Institute.

If I had to put a calculator to this intentional and irreversible problem, I estimate The Silver Institute has cost investors and miners nearly 2 trillion dollars in nominal terms.

But considering their director has been there for about 20 years, Year over Year deceptive practices, and their prime agenda to reward short sellers vs. Silver Discovery (north of 15 trillion dollars lost, the Delta difference of nominal versus where Silver should be, not including compounding losses)

- They have no intention of promoting Silver.

- When they publish something that looks like a “promotion,” it is just an attempt to establish some kind of “Silver Alibi”… “when Silver was murdered, we were over here.”

- When they publish some silver uses, it is about some measly category like Silver in ink, Silver in photography, Silver in fabrics, and Silver in windows. At the same time, they ignore Silver in the military, Silver in satellites, Silver in rockets, Silver in space stations, Silver in silver-zinc batteries, Silver in torpedos, Silver in nuclear weapons, Silver in Electric Trains, Robotics, AI and Quantum Computing.

- Yes, they had published some silver solar use. But if it hadn’t been for Chen Lin’s reports, they would still be under-reporting the silver loading within the Solar Industry.

- They only exist to confuse people on Silver.

And it gets worse.

Their main reason for existing is to form some “PSYOP” to self-proclaim themselves as “silver experts” when they are the opposite of Silver.

So, what is the opposite of Silver?

The US dollar (not backed by gold or oil) is only supported by decree, military goons, laws that don’t make sense, and the Federal Reserve. Now we can prove The Silver Institute and part of this group of gunsels.

The Silver Institute:

- They favor the laughable US dollar instead of Silver.

- The US dollar is such a topic of embarrassment.

- All serious silver stackers acknowledge this, but The Silver Institute does not.

- The US dollar is laughable, absurd, and preposterous.

- The US dollar has lost 98% of its value in a very short time.

- The US dollar is so pathetic that the majority of nations worldwide are dropping it like a hot potato.

- The only ones who don’t acknowledge these facts are Central bankers, governments, silver short sellers & The Silver Institute.

This is the case with the Silver Institute.

Analogy:

What if you were recruited to invest in Uranium because you believe this metal is the key to future energy.

You pour your life savings and research into this commodity only later to learn that the guy who led you into Uranium is a double agent. How would you feel if you learned later that the guy in charge of promoting Uranium is simultaneously working on the other side? What if you learn he is a lobbyist discouraging nuclear energy, working with environmental activists or fossil fuel stakeholders to stop nuclear energy and promote all the industries threatened by atomic power.

This is the working metaphor for understanding how The Silver Institute Operates:

Here is how this scam goes down:

- The “Uranium Institute” was formed out of the blue (no one asked for them), and they are self-proclaiming that they are the “official” gospel on Uranium.

- The Uranium Institute hires a “no bid” subcontractor called “Uranium Focus” to publish deceptive data on Uranium.

- The Uranium Institute throws up a website that is worth $500, but they probably spent $10,000 on it – LOL.

- They establish a street address in Washington DC (shared with someone else)

- They hide behind their name, Uranium Institute (after all, who will question the Uranium Institute), especially when they are so decorated by mainstream media for being some unearned “authority on Uranium.”

- Their legitimacy only comes from themselves, not their data science.

- After all, The World Uranium Survey, rubber-stamped by Uranium Focus, gives them the “false confidence” to trot around the globe, self-declaring themselves as experts.

- This is a very concerning practice.

- For Silver Institute to install some shadowy no-bid contractor to cherry-pick data leads to conflicts. Their no-bid contractor also works as a “double agent” for Central Banks. Now we have REAL TROUBLE FOLKS.

- They have used this “cover” to prioritize their interests over the public interest.

- Self-regulation in the financial sector has been associated with systemic financial risk, and there are concerns about its ability to effectively manage and reduce such risks. This is a similar dynamic with a self-proclaimed “institute.

Is this the case with the Silver Institute? Let’s begin our investigation.

Is Mike DiRienzo a double agent?

We are not sure but as information comes pouring out of The Pixy Portal the data points reveal quite a story.

- On his Linkedin page, the 62 year old DiRienzo lists having one job.

- Are we guessing he did nothing from age 16 to 42?

- Not the case. He has been very busy.

- Michael has had plenty of help and soon we will show you who else is involved in this elaborate scheme.

- Michael DiRienzo is an employee lobbyist of Klein & Saks Group LLC.

- The Silver Institute’s address is: 1400 I St, NW Suite #550, Washington, DC, 20005.

- The Klein & Saks Group’s address is: 1400 I St, NW Suite #550, Washington, DC, 20005.

Klein & Sak Group Lobbying Clients:

1999: Gold Institute

2000: Gold Institute

2001: Gold Institute

2002: Gold Institute

2003: Clients

- Council On Equitable Regulation/Taxation

- Industry Council On Tangible Assets

- Manganese Metal Co.

- National Mining Association

- Silver Institute

- World Gold Council

2004: Clients

- Council On Equitable Regulation/Taxation

- Kagin’s Inc

- Manganese Metal Co

- National Mining Association

- Silver Institute

- World Gold Council

2005: Clients

- Council On Equitable Regulation/Taxation

- Kagin’s Inc

- Manganese Metal Co

- National Mining Association

- Silver Institute

- World Gold Council

2006: Clients:

- Kagin’s Inc

- Manganese Metal Co

- National Mining Association

- Silver Institute

- World Gold Council

2007: Clients:

- Anglogold North America

- National Mining Association

- Silver Institute

- World Gold Council

2008: Clients:

- Anglogold North America

- Council on Equitable Regulation/Taxation

- National Mining Association

- Silver Institute

- World Gold Council

2009: Clients:

- Council on Equitable Regulation/Taxation

- Manganese Metal Co

- Silver Institute

- World Gold Council

2010: Clients:

- Council on Equitable Regulation/Taxation

- Manganese Metal Co

- World Gold Council

- Silver Institute

2011: Clients:

- Anglogold North America

- Dillion Gage

- World Gold Council

- Silver Institute

2012: Clients:

- Anglogold North America

- Dillion Gage

- World Gold Council

- Silver Institute

2013: Clients:

- Anglogold North America

- Dillion Gage

- World Gold Council

- Silver Institute

2014: Clients

- World Gold Council

- Silver Institute

2015: Client(s)

- Silver Institute

*Other Data Missing

2016: Client(s)

- Silver Institute

2017: Client(s)

- Silver Institute

2018: Client(s)

- Silver Institute

In part 2 of this investigative series we will introduce you to the man who worked as the original Silver Institute director. His name is Mr. Paul W. Bateman. Bateman has quite “an impressive” and “decorated” past including:

- Past or active President and Chief Executive Officer of the Klein Saks Group based in Washington D.C., since 1998.

- Past President of the Economic Club of New York. (an elitist think tank more sinister than World Economic Forum

- Past Chief Executive Officer of the International cyanide Management Institute.

- He also served (former President George H. W. Bush) as Deputy Assistant for Management from 1989 to 1993.

- He joined the Klein Saks Group in 1994.

- He served as the President of the Gold Institute, a North American industry group.

- He has led the Silver Institute and the Gold Institute and represents the World Gold Council, the Platinum Guild International (USA) Inc., the International Platinum Association and the National Mining Association.

- He has extensive experience in government having served as an aide to former President Nixon

- on the White House staff of former President Reagan

- deputy administrator of the Economic Development Administration at the U.S. Department of Commerce

- Deputy Treasurer of the United States. Talk about standing close to the money printers

- Supervising the U.S. Mint, Bureau of Engraving and Printing and U.S. Savings Bonds Division.

- He has been Chairman of Tri-Valley Corp. since November 22, 2011.

- He serves or has served as Chairman of the Board for the International cyanide Management Institute.

- Mr. Bateman has or had been a Director of Tri-Valley Corp. since 2007.

- Mr. Bateman served lead the silver institute prior to Mike DiRienzo but continues to represent the Silver Institute in various roles (tomorrow’s article)

- He served as member of the Union League Club of New York, a trustee of the Aldercroft Foundation and a Director of privately held Lixiviant, Inc.

- He served as Trustee of Whittier College.

- He is a graduate of Whittier College (less than 1200 students)

- Prior to Bateman attending Whittier Richard M. Nixon graduated summa cum laude from Whittier College.

- Nixon later became Governor of California, the 37th President and flipped the script in 1971 divorcing the US Federal Reserve note from Gold

- Is it possible that Bateman was involved in Nixon’s decision given all you have learned so far today?

The Silver Stackers Code

The Silver Stackers code is an unwritten set of rules and norms that govern behavior within the Silver Jungle.

It is a cultural code that Silver Stackers adopt to navigate our complex society where villagers are imprisoned as debt slaves by the parasitic class.

The Silver Stackers need this code for survival as each day, they are bombarded with false information from the Ministry of Propaganda, who read their scripts written by the Fiat overlords.

Here are the fundamental tenets of the Silver Stackers code:

Never snitch: Informing on fellow stackers to authorities is strictly against the Silver Stackers code and can lead to embarrassing consequences for the snitch. The Silver Institute’s Mike DiRienzo is considered a snitch for acting like a double agent or “an informant.” Saying he serves Silver while he fiercely defends The Federal Reserve Note.

Stack your Silver no matter the fake spot price: Stackers are expected to serve the community by stacking Silver in our #SilverSqueeze movement. In the times when Silver goes up, we cheer. We buy more at bargain prices when silver pricing is smashed down (by The Silver Institute, CFTC, the Crimex, Gov officials, and bankers).

Be tough: Fiat overlords and their goons will attack stackers and accuse them of being uneducated or misguided. This is their #1 gaslighting operation. Their #2 playbook is to try and cut off our sponsorships through covert phone calls, fake promises to “work together,” and other ways of “burning crosses” in our yards.

Their acts of terrorism and PSYOPS will not be tolerated because the Stackers are strong while the double agents (informers), aka manipulators, are weak.

Never be too friendly with bankers, short sellers, members of the Silver Institute, or Government officials: Overly friendly relationships with the Fiat overlords can be seen as a betrayal of fellow stackers.

The Silver Stackers conduct code is necessary to build solidarity among stackers. The code also signals unity and resistance against the adversarial fiat money system.

Informants or double agents like Jim Lewis and Mike DiRienzo, who break this code by snitching and playing both sides, will be targets of ostracism as they undermine the group’s unity and safety.

Code violators can face social isolation and embarrassment as the stacking population enforces the code to maintain order and respect within the Silver Stacker movement.

The Silver Institute is the opponent of Silver Stackers and Silver Investors.

Vince Lanci of GoldFix Tweets:

to be continued…