IRS Form 990 is an informational tax form that most tax-exempt organizations must file annually. In a nutshell, the form gives the IRS an overview of the organization’s activities, governance and detailed financial information.

Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify maintaining its tax-exempt status. In collecting this information, the IRS wants to ensure that organizations continue to qualify for tax exemption after the status is granted.

Some Facts

1. Silver institute in 2022 reported receiving approximately $1,267,000.00

2. There are 26 sponsors.

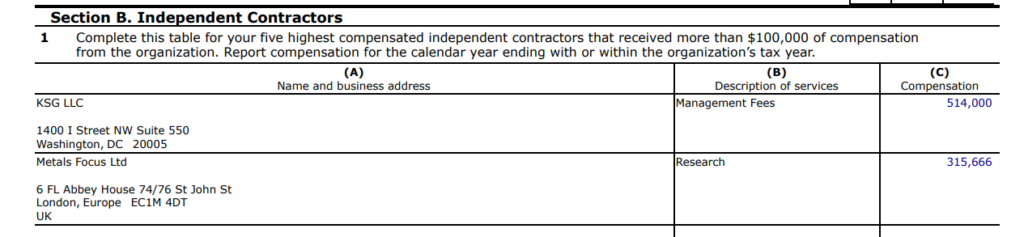

3. They pay Klein Saks Group $514,000 in 2022

4. They pay Metals Focus $315,666 in 2022

5. KSG LLC does business as Klein & Saks LLC

6. KSG LLC is owned by Paul Bateman per DC business records.

7. KSG LLC and Silver Institute occupy the same business address and located in the same suite.

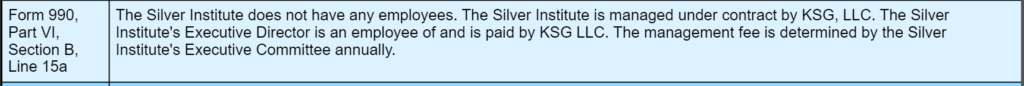

8. The SIlver Institute does not have employees.

9. The Silver Institute is managed under contract by KSG LLC

10. The SIlver Institute’s Executive Director is an employee of and is paid by KSG LLC.

11. The management fee is determined by the Silver Institute’s Executive Committee annually.

12. This 990 form was prepared by KOSCIW & ASSOCIATES LLC, which also prepares documentation for ICMI (International Cyanide Management Institute) which Paul Bateman is President and Chairman of the board of directors. International Cyanide Management Institute also shares the same address as The Silver Institute and Klein Saks (KSG Group)

13. Philip Klapwijk is also on the board of directors of International Cyanide Management Institute.

14. Philip Klapwijk is also employed by Metals Focus.

Go back to the Silver Academy Substack Story