1.4 km step-out hole on Queen Vein intersected 393 g/t Silver Equivalent* over 7.4 m

Vancouver, February 27, 2024 – Summa Silver Corp. (“Summa” or the “Company”) (TSXV:SSVR) (OTCQX: SSVRF) (Frankfurt:48X) is pleased to provide assay results from its first drill hole completed during the winter drill program at the high-grade silver-gold Mogollon Project, New Mexico (the “Mogollon Project”).

Key Highlights

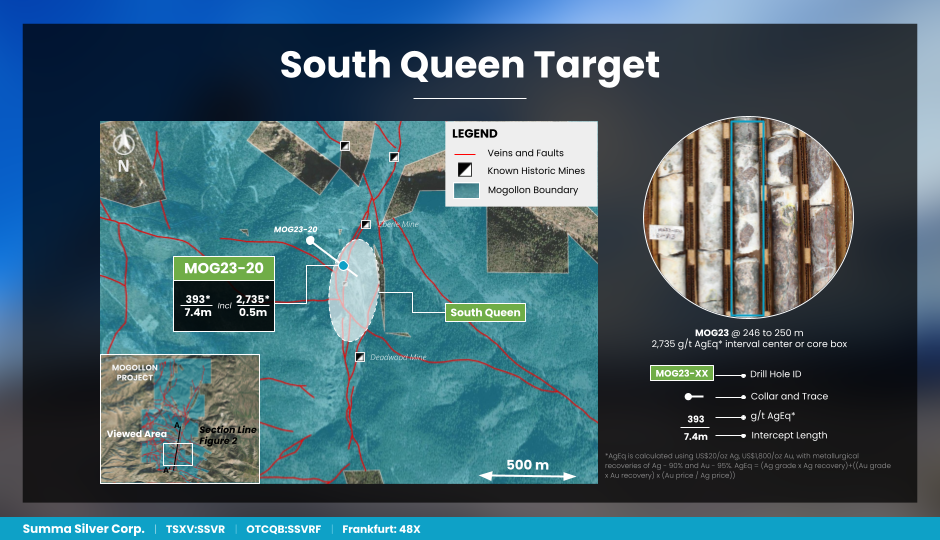

- First hole at the South Queen target intersected multiple zones of strong epithermal-related silver-gold mineralization, highlighted by:

- 393 g/t silver equivalent* (64 g/t Ag, 3.9 g/t Au) over 7.4 m from 242.4 m down hole (60 m vertical depth), including 2,735 g/t silver equivalent* (320 g/t Ag, 28.6 g/t Au) over 1.5 m, and

- 357 g/t silver equivalent* (186 g/t Ag, 2.2 g/t Au) over 0.9 m from 201.2 m down hole.

- Size and Scale on the Queen Vein: This hole represents a 1.4 km step out on the Queen Vein where mineralization remains open in all directions.

- Between Two Historic Producers: The newly intersected mineralized zone is located between the recently acquired Deadwood and Eberle mines, both of which were only mined at shallow-levels and remain untested at depth.

- Additional Exploration Upside: Results support the high-prospectivity of the entire Queen Vein where mineralization is open along-strike and down-dip warranting systematic follow-up drilling.

- Assays Pending: Drilling is now complete with results pending from two holesthat tested for mineralization along-strike and below the Eberle Mine.

*Silver equivalent is calculated using US$20/oz Ag, US$1,800/oz Au with metallurgical recoveries of Ag – 90%, Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)).

Galen McNamara, CEO, stated: “We designed this drill program to test the size and scale of mineralization on the Queen Vein. The targets were precisely planned and based on our extensive geological modelling efforts that have evolved over the past three years. Unsurprisingly, our first hole successfully intersected strong mineralization. We look forward to additional results and continuing to unlock value in what has long been an overlooked historic mining district.”

Mogollon Exploration Drill Program

The winter drill program at the Mogollon Project was designed to test the silver and gold potential of zones along the north-striking Queen Vein. The targets (South Queen and Eberle) are the result of extensive data compilation efforts which have evolved over several years and are designed to maximize discovery potential. The two targets are dispersed along 350 m of the Queen Vein south of the Consolidated target, where Summa focused its previous drill programs. The first hole of the program (MOG23-20) tested the South Queen target.

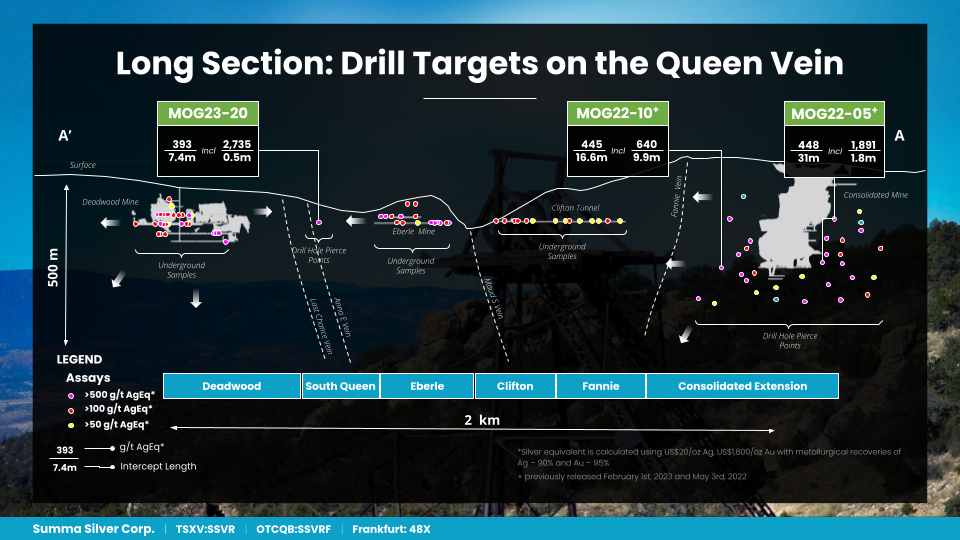

Figure 2: Long-section of the Queen Vein showing primary targets and pierce point of MOG23-20

The South Queen target is centered on the structural intersections between the east-west trending Last Chance and Anne E veins, and the north-south trending Queen vein. The first hole of the program (MOG23-20) was designed to test parallel vein-sets of the Queen vein system as well as for high-grade and plunging mineralization hosted along the intersection of the Queen vein and Last Chance veins. The hole was collared 250 northwest of the Last Chance mine portal in the hanging wall of the Last Chance vein. The hole intersected banded and locally brecciated Fanney rhyolite to 313 m downhole. At 201 m the hole intersected a weakly oxidised quartz-carbonate vein that yielded 357 g/t silver equivalent (186 g/t Ag, 2.2 g/t Au) over 0.9 m. Between 235 m and 264 m, the hole intersected a broad zone of strongly silicified and brecciated rhyolite cut by cm to meter-scale zones of quartz-carbonate vein with local silver-bearing sulfides (393 g/t silver equivalent over 7.45 m including 2,735 g/t silver equivalent over 0.5 m). Due to the shallow dip of the hole, this lower high-grade vein was intersected approximately 60 m below surface. The hole bottomed at 324 m in andesite of the Mineral Creek unit.

Table 1: Assay Results

Results from hole MOG23-20 strongly supports the high-prospectivity of the Queen Vein south of the Consolidated Mine target, which is 1.4 km to the north. At Consolidated, the Company has systematically tested for un-mined extensions of mineralization across a strike length of approximately 500 m, where many holes returned significant zones of high-grade silver and gold mineralization (e.g., 448 g/t silver equivalent* (129 g/t Ag, 3.88 g/t Au) over 31 m of MOG22-05 and 640 g/t silver equivalent* (306 g/t Ag, 4.26 g/t Au) over 9.9 m of MOG22-10; see the Company’s news releases dated May 3, 2022 and February 1, 2023) hosted in the broad, steeply dipping and complex Queen vein system. A similar systematic approach to drilling is warranted at the Queen South target to better define the lateral and vertical extent of vein-hosted mineralization. This zone, approximately 270 m north of the Deadwood mine underground workings and approximately 200 m south of the Eberle mine underground workings, is open in both directions along strike and down dip.

Table 2: Collar Information

Exploration Permit Affirmation

In a public hearing held on February 15, 2024 in Santa Fe the New Mexico Mining Commission (the “Commission”) voted unanimously (6-0) to affirm the Company’s Part 3 Minimal Impact Exploration Permit (the “Permit”). The Commission acts as the rulemaking and administrative review body for the 1993 New Mexico Mining Act (the “Mining Act”). Anyone affected by actions or rulings related to the Mining Act regulatory program may appeal that action to the Commission if they do not agree with the action or ruling provisions. The Commission will then hold a public hearing on the appeal and decide to uphold or overturn the action. The hearing on February 15, 2024 was held to address complaints made by a private citizen who alleged that the Mines and Minerals Division of the Energy, Minerals and Natural Resources Department of New Mexico (the “MMD”) failed to issue correct maps of the area permitted for exploration when granting the Permit. Company employees and consultants participated in the hearing as expert witnesses. The decision affirms the Permit and associated Findings of Fact made by the Director of the MMD which include, among other things, that the Mogollon Project is unlikely to have adverse impacts on threatened or endangered species, water resources or cultural resources.

Analytical and QA/QC Procedures

Drill core was sawn in half at Summa’s core logging and processing facilities at the Mogollon Project. All core samples were sent to Paragon Geochemical Laboratories in Sparks, Nevada for preparation and analysis. Paragon meets all requirements of the International Accreditation Service AC89 and demonstrates compliance with ISO/IEC Standard 17025:2017 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish and samples that assayed over 8 ppm were re-run via fire assay with a gravimetric finish. Silver, and trace elements were analyzed via inductively coupled plasma mass spectroscopy after four-acid digestion. Samples that assayed over 100 ppm Ag were re-run via fire assay for Ag with a gravimetric finish. In addition to Paragon quality assurance / quality control (“QA/QC”) protocols, Summa implements an internal QA/QC program that includes the insertion of sample blanks, duplicates and certified reference materials at systematic and random points in the sample stream.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp.

Summa Silver Corp. is a junior mineral exploration company. The Company owns a 100% interest in the Hughes Project located in central Nevada and the Mogollon Project located in southwestern New Mexico. The high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929, is located on the Hughes Project. The Mogollon Project is the largest historic silver producer in New Mexico. Both projects have remained inactive since commercial production ceased and neither have seen modern exploration prior to the Company’s involvement.

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

[email protected]

www.summasilver.com

Investor Relations Contact:

Giordy Belfiore

Corporate Development and Investor Relations

604-288-8004

[email protected]

www.summasilver.com

Read the entire press release here