Silver mining and investing in silver stocks require a solid understanding of specific geological terms. Familiarizing yourself with mining language is essential to navigate the industry successfully. This article provides a comprehensive glossary of important terms related to silver mining and investing, helping you grasp the vocabulary used by silver miners.

Key Takeaways:

- Geological terms are crucial for silver miners to effectively navigate the industry.

- Familiarizing yourself with mining terminology enhances your understanding of silver mining and investing.

- Understanding key geological terms enables you to make informed decisions and take advantage of opportunities in the industry.

- The glossary in this article provides a comprehensive list of important mining jargon used by silver miners.

- By grasping these terms, you can confidently participate in the complex world of silver mining.

Chemical Terminology

In the world of silver mining, understanding chemical terms is essential to navigate the industry successfully. Let’s explore some key chemical concepts related to silver.

Silver Chemical Symbol

The chemical symbol for silver is Ag, derived from the Latin term “Argentum.” The symbol Ag comes from its original Latin name, Argentum, which means “shining” or “white like silver.” This symbol is universally used to represent silver in chemical equations and scientific literature.

Purity of Silver Alloys

Silver alloys are formed by combining silver with other metals to modify its properties. The purity of silver alloys is measured by the amount of silver present. The most common categories include:

- Sterling Silver: This alloy is composed of 92.5% silver and 7.5% copper. It is widely used in jewelry and decorative objects.

- Britannia Silver: With a purity of 95.8%, this alloy is slightly purer than sterling silver and is often used in luxury items.

- Mexican Silver: Mexican silver has a purity of 95%, making it popular in traditional Mexican jewelry.

Silver Amalgam

Silver can also form an amalgam, a mixture of silver with other metals like gold, copper, or mercury. Amalgams have unique properties that make them useful in various industries. One common application is in dentistry, where silver amalgam fillings are used for dental restorations.

Understanding the chemical aspects of silver mining provides insight into its properties and applications. It also helps in identifying different silver alloys and the role of silver amalgam in various industries.

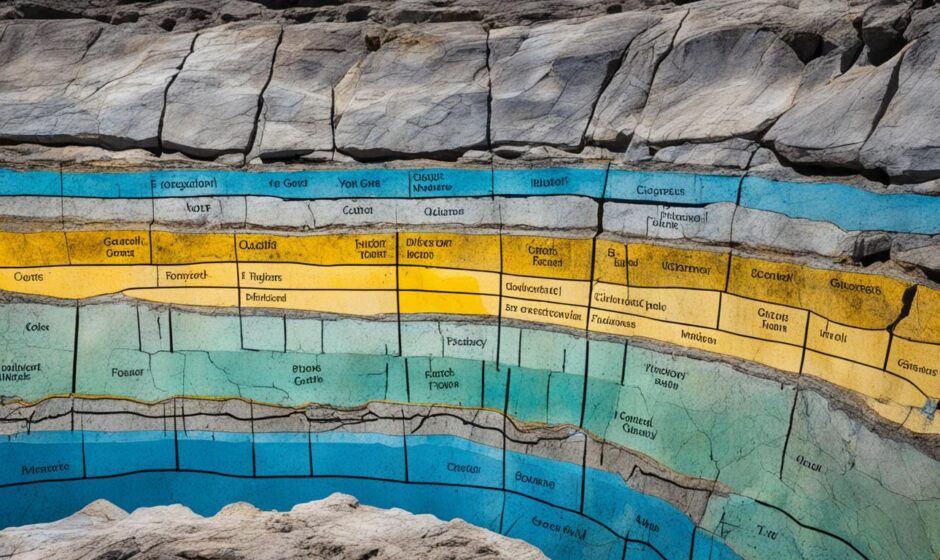

Geological Descriptions

Understanding geological descriptions is crucial for silver miners. Here are some key terms to familiarize yourself with:

- Alluvial deposits: Sedimentary material found in riverbeds or mountainous regions, sometimes containing silver.

- Complex ore: Ore that contains several minerals, with one or more being economically valuable.

- Gangue: Waste rock that needs to be separated from the ore during the mining process.

- Vein: A mineral-filled crack or fault in a rock.

Having a clear understanding of these geological terms will help silver miners navigate the complexities of the mining process and identify valuable resources. Take a closer look at the following table, which provides a comparison of different geological formations:

| Geological Formation | Description |

|---|---|

| Alluvial Deposits | Sedimentary material found in riverbeds or mountainous regions, containing potential silver deposits. Requires extraction through mining processes. |

| Complex Ore | Ore consisting of multiple minerals, with economically valuable minerals mixed in. Extraction process may involve separating individual minerals. |

| Gangue | Waste rock that needs to be removed during the mining process to extract valuable ore. Generally has no commercial value. |

| Vein | A crack or fault in a rock that is filled with minerals, often including silver. Veins can be narrow or wide and may run vertically or horizontally. |

Testing and Analysis

Testing and analysis are essential in silver mining to determine the quality and value of ore deposits. Various methods are employed to assess the precious metal content and processing potential. Let’s explore the key components of testing and analysis in silver mining:

1. Assay Test: An assay test is conducted to determine the amount of precious metals, such as silver or gold, present in the ore or mineral deposits. This test helps miners calculate the economic viability and potential profitability of mining operations.

2. Grade of Ore: The grade of ore is a measure of the concentration of the valuable metal, such as silver, per tonne of ore. It indicates the purity and quality of the mineral deposits and plays a crucial role in determining the potential profitability of mining operations.

3. Recovery Rate: The recovery rate is the proportion of valuable metal obtained during the ore processing stage. It represents the efficiency of the extraction and refining processes and directly impacts the overall profitability of mining operations.

To ensure accurate testing and analysis, specialized laboratories and equipment are employed. These assessments provide valuable insights for miners and investors in making informed decisions regarding silver mining and investment strategies.

Note: The image above represents an assay test, one of the essential components of silver mining testing and analysis.

Next, we’ll explore the crucial stages of geological exploration and feasibility studies in the silver mining industry.

Exploration and Feasibility

Silver miners engage in geological exploration to discover and extend economically exploitable mineral deposits. This process involves conducting extensive research, engineering work, and optimization to support mining activities. A crucial aspect of exploring potential mining sites is conducting a feasibility study. Feasibility studies provide economic assurance for mining and production activities by assessing various factors such as resource estimation, technical viability, and financial considerations.

During the geological exploration phase, miners employ various techniques to locate areas with high potential for silver deposits. This typically involves geological mapping, geophysical surveys, and geochemical analysis. By analyzing surface and subsurface data, geologists can identify potential ore bodies and define their boundaries.

Once a potential deposit is discovered, the next step is to conduct a feasibility study. This study evaluates the economic viability of mining the deposit. It takes into account factors such as the size and grade of the deposit, estimated production costs, and potential market demand. By thoroughly analyzing these factors, mining companies can determine if the project is economically feasible and can generate sufficient returns on investment.

Feasibility Study Components

A typical feasibility study consists of several key components, including:

- Resource Estimation: This involves determining the size, grade, and quantity of silver and other minerals present in the deposit. It is crucial for assessing the economic potential of the project.

- Technical Evaluation: This component focuses on evaluating the technical aspects of the mining operation, including mine design, infrastructure requirements, processing methods, and environmental considerations.

- Financial Analysis: The financial analysis examines the projected costs of developing and operating the mine, as well as the projected revenue from the sale of silver. It also includes an assessment of the project’s financial viability, such as the internal rate of return (IRR) and payback period.

- Risk Assessment: This component identifies the potential risks and uncertainties associated with the mining project, such as commodity price fluctuations, regulatory changes, and environmental impacts. It also outlines strategies to mitigate these risks.

The findings of the feasibility study provide the basis for investment decisions and further development of the mining project. If the study indicates favorable economic conditions and technical feasibility, the project can proceed to the development and production phases.

| Benefits of Feasibility Studies | Example |

|---|---|

| Minimize Financial Risks | By conducting a thorough feasibility study, mining companies can assess the potential risks and uncertainties associated with the project. This allows them to make informed decisions and allocate resources wisely. |

| Optimize Resource Allocation | A feasibility study provides valuable insights into the projected costs and revenue streams of a mining project. This information helps determine the most efficient allocation of resources, ensuring optimal production and profitability. |

| Secure Financing | Feasibility studies are essential for attracting investors and securing financing for mining projects. The study’s findings give potential investors confidence in the project’s viability and potential returns. |

| Ensure Regulatory Compliance | Feasibility studies consider the legal and environmental aspects of mining operations. By identifying and addressing compliance requirements early on, companies can avoid costly delays and penalties. |

“A comprehensive feasibility study is critical for silver mining projects. It provides a clear understanding of the project’s technical and economic viability, enabling informed decision-making and increasing the chances of success.”

Mining Processes

Different methods are employed for silver ore extraction in mining. Leaching and blasting are two crucial processes used in silver mining operations.

Leaching:

Leaching is a process that involves extracting a soluble metallic compound from ore using solvents. In the case of silver mining, leaching is used to dissolve the silver content from the ore.

The process of leaching typically involves the following steps:

- Crushing: The silver ore is first crushed into smaller pieces to increase the surface area for chemical reactions.

- Heap or tank leaching: The crushed ore is then stacked in heaps or placed in tanks, where a leaching solution is applied.

- Chemical reaction: The leaching solution, usually containing a specific chemical compound, interacts with the silver in the ore, dissolving it into the solution.

- Separation: The silver-containing solution is separated from the solid residue, which is often called the “pregnant leach solution.”

- Recovery: The silver is typically recovered from the pregnant leach solution through further processing, such as precipitation or electrowinning.

“Leaching is an effective method for silver extraction as it allows for the selective dissolution of the metal from the ore, resulting in higher silver recovery rates.”

Blasting:

Blasting is another essential process in silver mining. It involves drilling holes in rocks specifically for explosive purposes. Blasting is primarily used to break down the rock formation and release the silver-containing ore for further processing.

The blasting process in silver mining typically involves the following steps:

- Drilling: Holes are drilled into the rock formation using specialized equipment.

- Charging: Explosive materials are placed into the drilled holes.

- Blasting: The explosives are ignited, resulting in a controlled explosion that breaks down the rock formation.

- Fragmentation: The explosion fragments the rock into smaller pieces, making it easier to extract the silver ore.

“Blasting is a critical step in silver mining operations as it allows for efficient access to the silver-containing ore by fragmenting the rock.”

Market and Industry Terms

Understanding market and industry terms is crucial for silver miners and investors. It allows them to navigate the dynamic landscape of the silver market with confidence and make informed decisions. In this section, we will explore three key terms that are essential for understanding market trends and industry dynamics: bull market, bear market, and commercial traders.

1. Bull Market:

A bull market is a term used to describe a period of rising or expected rise in the stock market. It signifies optimism and investor confidence, where prices are generally on an upward trajectory. In a bull market, demand for silver and other commodities tends to be high, leading to increased prices and potential profits for investors.

“A bull market is like a raging bull, charging ahead with strength and vigor. It is a time of optimism and positive sentiment among investors.”

2. Bear Market:

On the opposite end of the spectrum, a bear market refers to a period of falling or expected fall in the stock market. It is characterized by pessimism, negativity, and declining prices. In a bear market, silver and other commodities may face decreased demand and lower prices. Investors often adopt a cautious approach to protect their investments during this period.

“A bear market can be a challenging time for investors. It requires caution, adaptability, and a strategic approach to minimize losses and identify opportunities.”

3. Commercial Traders:

Commercial traders, also known as the US futures market, play a significant role in the silver industry. They are typically precious metals producers or refining companies that participate in the futures market to manage their exposure to price fluctuations. Commercial traders utilize futures contracts and options to hedge against potential price risks, ensuring stability in their operations.

To better understand the significance of these terms, let’s take a closer look at their relationship and impact on the silver market:

| Bull Market | Bear Market | Commercial Traders | |

|---|---|---|---|

| Definition | A period of rising or expected rise in the stock market. | A period of falling or expected fall in the stock market. | Precious metals producers or refining companies participating in the futures market. |

| Impact on Silver | Increased demand and potential price appreciation. | Decreased demand and potential price depreciation. | Stability and price risk management through futures contracts and options. |

By understanding these market and industry terms, silver miners and investors can stay informed about the current market climate and make strategic decisions to maximize their potential returns. Now that we have explored these crucial terms, let’s delve further into other aspects of the silver industry and its investment opportunities.

Precious Metal Investments

Investing in silver mining provides opportunities for precious metal investments. It allows individuals to diversify their investment portfolios and potentially benefit from the value of silver bullion.

Bullion refers to physical forms of precious metals, such as coins or bars, that hold intrinsic value. These tangible assets act as a store of wealth and can provide a hedge against inflation and economic uncertainties.

When investing in silver or other precious metals, it’s important to consider the tax implications. Capital gains tax is levied on the profits made from selling assets, including bullion. It’s crucial to understand the tax laws and regulations in your jurisdiction to ensure compliance and maximize investment returns.

Diversification is a key strategy for minimizing risk in investment portfolios. By spreading investments across different asset classes and sectors, including precious metals like silver, investors can mitigate the potential impact of market volatility on their overall portfolio performance.

Investing in silver mining and bullion offers the opportunity to participate in the silver market’s potential growth and stability while diversifying investment holdings. With careful planning and understanding of tax obligations, precious metal investments can play a significant role in a well-rounded investment strategy.

Key Points:

- Precious metal investments in silver mining provide diversification in investment portfolios.

- Bullion, such as coins or bars, is a tangible store of wealth and a hedge against inflation.

- Investors should consider capital gains tax implications when selling bullion.

- Diversification across different asset classes helps minimize investment risk.

Industry Operations and Processes

The operations and processes involved in the silver mining industry encompass various techniques. These techniques are vital for the extraction and refinement of silver, ensuring its usability across different applications.

Blast Furnace

The blast furnace plays a significant role in the production of metals. By combining ores with fluxes and fuels, the blast furnace facilitates the creation of metals, including silver. It provides the necessary heat and chemical reactions to extract and refine silver from its ores.

Metallurgy

Metallurgy encompasses the entire process of working with metals, from their extraction to their refinement and fabrication. In the case of silver mining, metallurgy ensures that the silver extracted from ores is purified, resulting in a high-quality metal that meets industry standards.

Malleability

Malleability is a crucial property of silver. It refers to its ability to be shaped or extended through hammering or forging without breaking or cracking. The malleability of silver makes it highly versatile and suitable for various applications, such as jewelry making, silverware production, and industrial uses.

In summary, the operations and processes in the silver mining industry rely on techniques such as the blast furnace and the principles of metallurgy. These techniques enable the extraction, refinement, and fabrication of silver. Additionally, the malleability of silver makes it a valuable and versatile metal in various industries.

Market Conditions and Contracts

Market conditions and contracts play a significant role in the silver mining and trading industry. Understanding these factors is crucial for investors and miners to make informed decisions. Let’s explore the key terms and concepts related to market conditions and contracts in the silver market:

Backwardation

In the silver market, backwardation refers to a situation where future market prices are progressively lower than the nearest month. This condition indicates an immediate shortage of silver or heightened demand in the current market, causing prices for future contracts to decrease. Backwardation can occur due to factors such as supply disruptions, geopolitical events, or increased market uncertainty.

Contango

Conversely, contango describes a market condition where future prices gradually increase compared to the spot price. This condition typically occurs when there is an oversupply of silver or a temporary decrease in demand. Investors and traders may take advantage of contango by buying silver at the spot price and simultaneously selling futures contracts to profit from the price difference.

Silver Futures

Silver futures are agreements between buyers and sellers to buy or sell a specified amount of silver at an agreed-upon price and date in the future. These contracts allow investors to hedge against price fluctuations or speculate on silver price movements. Futures contracts are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the Tokyo Commodity Exchange (TOCOM).

Over-the-Counter Options

Over-the-counter (OTC) options are flexible agreements between buyers and sellers that allow them to trade silver options outside of regulated exchanges. These contracts provide more customization and flexibility compared to standard exchange-traded options. OTC options are commonly used by institutional investors and experienced traders to manage risk, create tailored investment strategies, or gain exposure to specific market conditions.

| Market Condition | Description |

|---|---|

| Backwardation | A condition where future prices are lower than the nearest month, indicating immediate silver shortage or heightened demand in the market. |

| Contango | A market condition where future prices gradually increase compared to the spot price, indicating an oversupply of silver or decreased demand. |

Understanding market conditions and the various contracts available in the silver market is essential for investors and miners alike. By staying informed about backwardation, contango, silver futures, and over-the-counter options, you can navigate the market effectively and make informed investment decisions.

Legal and Tax Considerations

Legal and tax considerations play a vital role in the silver mining industry. It is crucial for silver miners and investors to understand the implications of mineral rights, production costs, and reserve classification.

Mineral Rights: Mineral rights determine ownership and access to mineral deposits. Companies or individuals with mineral rights have the legal authority to explore, extract, and profit from the minerals within a specific area.

Production Cost: Production cost refers to the expenses associated with mining and producing metals. It includes factors such as labor, equipment, energy, and operational expenses. Understanding production costs is essential for evaluating the profitability of silver mining operations.

Reserve Classification: Reserve classification categorizes the amount of mineral resources within certain boundaries based on economic variables and deposit characteristics. It helps investors and industry professionals assess the potential availability and future profitability of silver reserves.

By considering these legal and tax aspects, silver miners and investors can navigate the industry effectively and make informed decisions.

Silver Products and Materials

Silver is a versatile metal with a wide range of applications and forms. Understanding the different types of silver products and materials is essential for anyone involved in the silver industry.

Commercial Silver

One form of silver frequently used in the industry is commercial silver. This refers to silver that is .999 fine, meaning it has a purity level of 99.9%. Commercial silver is often sold in large 1000 oz. bars, making it a popular choice for investors and industrial users alike.

Sterling Silver

Another commonly encountered form of silver is sterling silver. Sterling silver is an alloy made up of 92.5% silver and 7.5% copper. This combination provides the metal with added strength and durability, making it suitable for various jewelry and decorative items.

Silver Plating

Silver plating is a process used to coat base metal objects with a thin layer of fine silver. This is accomplished through electrolysis, where an electric current is passed through a solution containing silver ions. The silver ions bond with the surface of the base metal, creating a layer of silver that enhances the appearance and provides protection against corrosion.

As shown in the table below, each form of silver serves different purposes and possesses unique characteristics:

| Silver Form | Purity | Common Applications |

|---|---|---|

| Commercial Silver | .999 | Investments, industrial use |

| Sterling Silver | 92.5% silver, 7.5% copper | Jewelry, silverware, decorative items |

| Silver Plating | Thin layer of fine silver | Coating base metal objects for aesthetic and protective purposes |

Understanding the various forms of silver opens up a world of opportunities for those involved in the industry. Whether you’re an investor looking to diversify your portfolio or a jeweler creating exquisite pieces, having a comprehensive knowledge of commercial silver, sterling silver, and silver plating is essential for success.

Investment Strategies and Options

Silver mining and investing offer various strategies and options for investors. By understanding these approaches, you can maximize your investment potential in the silver market. Explore the following key strategies:

Hedging

Hedging is an effective way to minimize financial risk or loss in the volatile silver market. Investors can hedge their silver investments by diversifying into other commodities or futures contracts. This strategy helps offset potential losses by balancing investments across different asset classes.

Diversification

Diversification is a proven method to reduce risk in any investment portfolio. By allocating a portion of your investment to precious metals like silver, you can safeguard against the inherent volatility of other asset classes. Diversifying your assets strengthens your financial position and provides stability during market downturns.

Options

Options offer investors the flexibility to buy or sell securities or commodities at a predetermined price within a specific timeframe. This strategy enables investors to capitalize on market fluctuations and optimize their silver investments accordingly. Options provide opportunities for both short-term gains and long-term investment strategies.

Joint Venture

A joint venture is a collaborative partnership between two or more entities for mineral exploration or mining activities. By pooling resources, expertise, and capital, investors can access larger mining projects with higher profit potential. Joint ventures allow for shared risks and rewards, providing an avenue for expanded exploration and increased silver production.

| Investment Strategy | Description |

|---|---|

| Hedging | Minimizing financial risk through diversification into other commodities or futures contracts. |

| Diversification | Allocating a portion of investments to precious metals like silver to reduce overall portfolio risk. |

| Options | Buying or selling securities or commodities at a fixed price within a specific timeframe. |

| Joint Venture | Collaborative partnership between entities for mineral exploration or mining activities. |

Each investment strategy offers unique benefits and considerations. By carefully evaluating these options, investors can develop a well-rounded approach to silver mining and investing, tailored to their specific financial goals and risk tolerance.

Market Pricing and Trading

Understanding market pricing and trading is crucial for silver miners and investors. Being knowledgeable about the cash market, spot price, and exchanges is essential for making informed decisions.

The Cash Market

The cash market refers to immediate settlement of a commodity at its required price. In the silver mining industry, it involves the buying and selling of physical silver or silver derivatives for immediate delivery and payment.

The Spot Price

The spot price represents the current market price of silver. It is the price at which silver can be bought or sold for immediate delivery. The spot price fluctuates constantly based on various factors such as supply and demand, economic conditions, geopolitical events, and market sentiment.

Exchanges

Exchanges are locations where brokers conduct business, such as stock or commodity exchanges. In the silver market, exchanges serve as platforms for buying and selling silver contracts, including futures and options.

Environmental Considerations

The silver mining industry is increasingly prioritizing environmental considerations and sustainability goals. Junior mining companies are striving to reduce emissions and implement sustainable practices throughout their operations. As part of this commitment, traditional processes like blast furnaces are being phased out in favor of cleaner alternatives.

The Shift to Cleaner Practices

One of the key environmental considerations in the silver mining industry is emissions reduction. Mining operations can contribute to air pollution through the release of greenhouse gases and other harmful substances. By adopting new technologies and practices, mining companies can significantly reduce their emissions and minimize their environmental impact.

“The mining industry plays a crucial role in global sustainability efforts. By implementing emissions reduction strategies, mining companies can contribute to a cleaner and more sustainable future.”

In addition to emissions reduction, sustainability goals are driving the adoption of environmentally friendly practices in the silver mining industry. Companies are exploring innovative solutions such as renewable energy sources, water conservation measures, and responsible waste management to minimize their ecological footprint.

Collaboration and Accountability

Achieving sustainability goals requires collaboration and accountability among all stakeholders in the silver mining industry. Governments, mining companies, and local communities are working together to develop and enforce regulations that promote environmental protection and sustainable practices.

Transparent reporting and monitoring systems are integral to tracking progress and ensuring compliance with sustainability goals. Mining companies are increasingly investing in technologies that enable real-time data collection and analysis, allowing them to make informed decisions and continuously improve their environmental performance.

Silver Mining and a Greener Future

The silver mining industry understands the importance of embracing sustainable practices and reducing environmental impact. By prioritizing emissions reduction and sustainability goals, mining companies are paving the way for a greener future in the industry.

As the industry continues to evolve, it is crucial for all stakeholders to collaborate and prioritize environmental considerations. By embracing cleaner practices and technologies, the silver mining industry can achieve its sustainability goals and contribute to a more environmentally conscious and responsible mining sector.

| Environmental Considerations in the Silver Mining Industry | Benefits |

|---|---|

| Emissions Reduction | – Improved air quality – Reduced environmental impact – Mitigation of climate change |

| Sustainability Goals | – Enhanced ecological sustainability – Resource conservation – Responsible waste management |

| Collaboration and Accountability | – Effective regulation and oversight – Stakeholder engagement – Transparent reporting and monitoring |

Conclusion

Understanding geological terms and mining terminology is vital for success in the silver mining industry. By familiarizing yourself with these terms, such as alluvial deposits, complex ore, gangue, and vein, you can navigate the complex world of silver mining and investing more effectively.

Similarly, gaining knowledge of mining jargon, like assay test, grade of ore, and recovery rate, will enable you to make informed decisions and maximize your opportunities in this industry.

Having a grasp of market and industry terms, such as bull market, bear market, and commercial traders, is crucial for silver miners and investors alike. It allows you to stay informed and make strategic choices in the ever-changing market conditions.

Overall, by understanding the geological terms, mining terminology, and silver mining vocabulary used by industry professionals, you will have a solid foundation to navigate the silver mining industry successfully and capitalize on its exciting prospects.